Systems and Apps

At Finling, we pride ourselves on being able to stay abreast of the ever-racing tide of developments in accounting technology. The software and apps that we have carefully trialled and selected are so well known to us that we can get quite creative with their function. Our team regularly uses this familiarity and knowledge to make the technology perform in ways that overcome common operational barriers and certain ‘limited’ functions. This means that we actually enhance the quality and performance of the software we use.

To stay at the cutting edge of finance technology, we maintain strong working relationships with software providers, raising queries with them, providing our feedback, and pushing for certain improvements – all in order to get the tools to work better for the specific needs of our clients. These changes often allow us to work in different and exciting ways and so we wanted to share how the technology is progressing, with you.

Finling’s Assistant Accountant and App Advisor, Toni Dragu, is our point person for such nouveau tech efforts, and he is now contributing to this ‘Systems’ series of posts. Each write-up will be made up of a ‘Deep Dive’ on a topic we think is particularly pertinent to the current fin-tech landscape and, also, a few updates, to help keep everyone tuned into the tech world. We will also make sure to include any security tips we want to bring to your attention.

The Deep Dive

Credit Limits

Back in 2002, Xero started introducing an important new credit limit feature. After a few rounds of updates, this now has quite a good feature set, so we wanted to take the time today to highlight it for you.

Who would use this feature?

Any company that invoices their customers and allows them to pay those invoices on credit terms.

One problem that can arise with invoicing on credit terms is when customers are not paying (or not paying promptly), but you keep offering and invoicing for new services/goods. In this situation, your financial exposure to the customer just keeps on going up, and your cashflow deteriorates.

Eventually, you may have to write off bad debts, employ credit collection services to recover the debt, or end up with a chaotic or poor customer relationship.

Credit limits can help by stopping invoices from being raised when a client is over their limit. This new feature in Xero provides businesses with the ability to better control the way they invoice and manage customer relationships.

How it works:

First, please note, if you want to get access to these new credit limit features, you must be using the “new invoicing” functions in Xero, rather than the older “classic” sales invoicing.

Also, this is primarily aimed at people invoicing directly from Xero, and not from a linked CRM system.

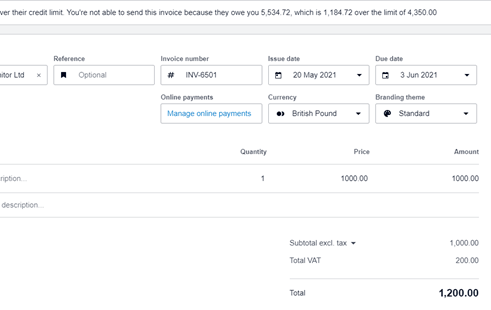

Essentially, the user is notified with an error message if they try to raise an invoice that would put a customer over a pre-determined credit limit.

And, if you chose to enable invoice blocking, they won’t be able to send the invoice. See below image as an example:

In this way, Xero allows you to choose whether users are only notified when the credit limit will be breached, or notified and also restricted from approving that invoice altogether (until the outstanding invoices are settled or the credit limit is increased).

The invoices that cannot be approved will be automatically saved to ‘Drafts’, and the responsible user can then approve and send them at a later stage.

The user can always see the credit limit status in the draft invoices screen or the awaiting payments screen.

They can also see the credit limit settings and verify what the available credit currently is in the contact record.

Please do contact us here at Finling if you would like to initiate a review of your sales invoicing process to make it more efficient or more effective, in terms of collecting cash.

Lastly, for your reference, here is the Xero help page on the new Credit Limit features.https://central.xero.com/s/article/Set-a-credit-limit-for-a-customer

Updates

Payroll Payments

When your company is small it is quite easy to make individual payments to your staff on payday. However, once the number of staff starts to grow, this can present a few problems:

The time it takes to set up each new employee’s bank details

The time it takes to make a large number of individual payments

Increased risk of making an error in the amount paid

Inability to delegate any part of this process, even though setting up the payments is just admin and the authorisation is the place where you really need to maintain control

For many of our clients, we set up payment batches and submit them for authorisation. This means that you, the client, retain control of authorisation, and, also, of sending the single funding payment that is required to cover the batch. But Finling can take on the admin burden for you.

In general, when we do this, it is for supplier payments, expense claims, salary payments, and the monthly HMRC PAYE/NIC payment.

However, if you only want to ask us to create and upload the salary payments, there is now a new facility available from our payroll software supplier, Modulr, that has enables us to offer this as a standalone service, with your other types of payments operating in the same way as before.

Please ask if you would like a quote for this! To do so, contact Finling’s payroll at payroll@finling.co.uk

Updates

Dext Prepare: New Email-in addresses

Our old friend, ReceiptBank, recently rebranded and is now called Dext Prepare! Along with this comes a new domain for the email-in addresses that we all use to forward paperwork on to the platform.

Conveniently, Dext has created a system such that the old email addresses still work as well as the new ones. Using the new address is not mandatory for some time, but you may want to switch over now and then never have to do it in the future.

Main Points:

@receiptbank.me has changed to @dext.cc.

You don’t have to do any set-up, the old @receiptbank.me addresses have automatically been moved to the new @dext.cc domain.

Dext will support the old email-in addresses for a few years, so you have plenty of time to switch over.

Example: if your email-in was business123@receiptbank.me, you can now start using the new business123@dext.cc. Or, you can continue to use the old one, in either case, the paperwork will reach us.

Additionally, If you want to log-in to Dext Prepare via the browser, please use this new link: https://app.dext.com/

Security Update

Xero: Multi Factor Authentication

Over the next 12 months, Xero is planning to make Multi Factor Authentication (MFA) mandatory for all Xero accounts globally.

MFA is designed to combat one of the most common types of cybercrime, phishing, which is an attempt to access your online accounts and steal your personal and business information.

For the moment this is optional, but you should do it anyway!

Here's how it works:

You will be asked for a code to access your Xero account when you log-in for the first time from a new device or browser, and then every 30 days after your device is recognised by that first successful login.

MFA makes it difficult for anyone who may find your password to access your account, as it doubles the elements required to access a Xero account – entry requires two devices.

The code you will get by linking a mobile app such as Google Authenticator or Authy to your Xero account

You can set up MFA by going to https://identity.xero.com/account or from https://go.xero.com/ > Profile icon > Account > Multi-factor authentication

For more information please see https://devblog.xero.com/why-were-securing-all-accounts-with-multi-factor-authentication-1285b181d575